The US economy remained shockingly robust in the fourth quarter to close out a remarkably strong 2023 as consumers and businesses continued to spend, crushing expectations of a recession.

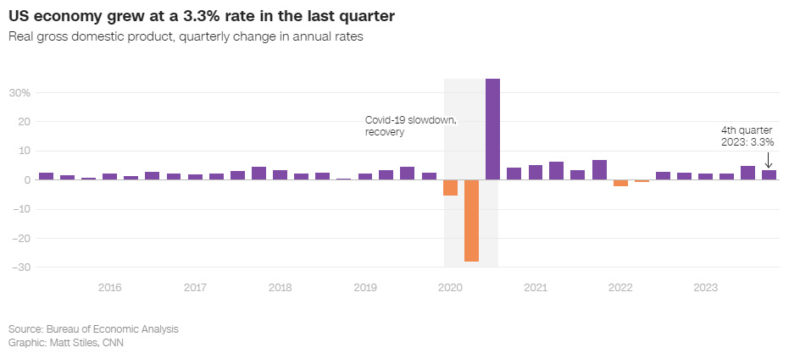

Gross domestic product, the broadest measure of economic output, rose at a seasonally and inflation-adjusted annualized rate of 3.3% from October through December, the Commerce Department reported Thursday.

That was slower than the blistering 4.9% rate from July through September, when American consumers splashed out on services and goods. Growth in 2023 overall, from January through December of last year, registered at a robust 2.5% rate.

But the fourth quarter’s rate trounced the 1.5% that economists were expecting, according to FactSet estimates. The economy’s strength in the final months of 2023 was broad based, driven by consumer spending, business investment, government outlays, exports and improvements in housing conditions.

Consumer spending, which accounts for about two-thirds of the US economy, grew at a healthy 2.8% rate in the fourth quarter, a slightly softer pace than the 3.1% rate in the prior three-month period. Meanwhile, business spending accelerated to a 1.9% rate, up from 1.4%.

“Prospects are good that the economy will continue to perform well this year,” Scott Hoyt, senior director at Moody’s Analytics, said in a release. “Consumers are doing their part and spending just enough to support broader economic growth.”

Thursday’s GDP report shows that the US economy has cooled some in recent months, but it’s not clear if that was enough of a slowdown to keep the Federal Reserve on track to cut interest rates any time soon.

Fed Governor Christopher Waller, an influential official at the central bank, said in a speech earlier this month that if “economic activity that seems to have moderated in the fourth quarter of 2023 does not play out” then that could delay rate cuts. Market expectations of that first rate cut coming in March have been crumbling in recent weeks.

A robust economic landscape for now

As the United States gears up for a presidential election, the latest GDP reading provides further evidence that the economy is nowhere near recession territory.

Americans are still opening their wallets and US consumer sentiment is soaring, mostly thanks to slowing inflation. That’s on top of a rallying US stock market beefing up Americans’ retirement accounts.

That all paints a vivid picture of a robust economic landscape, which should improve President Joe Biden’s lackluster ratings on the economy in the polls, according to economists. In separate speeches Thursday, Biden and Treasury Secretary Janet Yellen are expected to tout the strong economy while noting that there is still inequality to be addressed.

“President Biden and I believe that GDP growth is not meaningful if it is not shared; if it doesn’t impact the lives of these Americans,” Yellen said in prepared remarks.

Economists and Fed officials widely expect the US economy to run at a slower pace this year compared to 2023, but not contract. That means the Fed still has a decent shot at defeating inflation without mass job losses, known as a soft landing.

“We continue to see a soft landing as the most likely outcome this year even if a collection of headwinds and risks means that recession odds are around 35%,” Lydia Boussour, senior economist at EY-Parthenon, wrote in a note Thursday.

“While there is no doubt the economy still has some winds in its sails, we believe cooler days are on the horizon,” she added.

What it all means for the Fed

While the GDP report showed that growth remained robust in the fourth quarter, it also didn’t show any worrying signs of inflation reigniting.

The Personal Consumption Expenditures price index excluding food and energy prices, a closely watched measure of underlying inflation, held steady at 2% in the October-through-December period for the second straight quarter. That’s right at the Fed’s official target.

Still, Fed officials have said they likely need to see “below-trend growth” to be assured that inflation is sustainably under control. The Fed’s mechanism of slowing inflation is by deliberately cooling the economy through higher interest rates, which are currently nestled at a 23-year high.

Fed officials convene in Washington next week for their latest monetary policy meeting, and they’re widely expected to hold rates steady for the fourth consecutive meeting.

Next week’s bevy of economic news — from Fed Chair Jerome Powell’s press conference to the first jobs report of 2024 — should help set the narrative straight on what the Fed will likely do in the spring.

“A rate cut in March seems less likely, but investors will still have several key reports ahead of them in the next several weeks,” Jeffrey Roach, chief economist at LPL Financial, said in a note.

Source: cnn.com